Understanding the complexities of legal arrangements can be daunting, especially when planning for the future care of loved ones. A Power of Attorney (POA) is a crucial legal document that allows individuals to designate someone to make decisions on their behalf, ensuring their wishes are respected even if they become unable to express them. This guide provides a comprehensive overview of POAs, offering insights into their various types, benefits, and how to establish one.

What is a Power of Attorney?

A Power of Attorney (POA) is a legal document that grants authority to a designated person, known as the agent or attorney-in-fact, to act on behalf of another individual, referred to as the principal. This empowers seniors to ensure their preferences are upheld during emergencies or if they become incapacitated and unable to manage their affairs independently.

Key Considerations When Establishing a Power of Attorney

It’s important to remember that a POA cannot be created “over” someone else. The principal must be the one to initiate the process of creating their POA, granting the power to act on their behalf. Additionally, the principal must be mentally competent at the time of signing for the POA to be valid.

How Does a Power of Attorney Function?

A POA grants a chosen agent, often an adult child, relative, or trusted friend, the ability to make significant decisions for the principal. This places a legal obligation on the agent to act in the principal’s best interests, a responsibility known as a fiduciary duty.

The agent’s authority, including its type and timing, depends on the specific language within the POA document itself.

Types of Power of Attorney

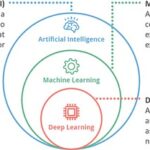

Understanding the different types of POA is essential for selecting the option that best suits specific needs. Common types include general, limited, durable, and springing POAs. These options empower seniors to tailor the scope and timing of the agent’s authority according to their unique medical and financial requirements, often with the guidance of an elder law attorney. Some POA types may not be available in all states, making it important to consult legal counsel to understand local regulations.

- General Power of Attorney: A general POA grants the agent broad authority to act on the senior’s behalf across various matters, including healthcare decisions, document signing, and bill payments. Powers can be divided into separate POAs, such as a medical POA, which allows the agent to make only medical decisions.

- Limited Power of Attorney: This type of POA allows a senior to grant someone authority over specific matters outlined in the document. The agent’s decision-making power is limited to the specific tasks or situations detailed in the POA. For example, if a senior resides in a nursing home and wants to sell their home, they can specify in their financial POA that their agent can only sign real estate documents on their behalf.

- Durable Power of Attorney: A durable POA becomes effective upon signing and remains valid until the principal revokes the document or passes away. Unlike a non-durable POA, a durable POA remains valid even if the principal becomes incapacitated.

- Springing Power of Attorney: This POA takes effect only when specific conditions outlined in the document are met, such as the principal becoming incapacitated due to illness or accident. Seniors seeking to maintain their autonomy often prefer this type, though it can lead to delays if determining capacity is unclear.

Without a POA, adult children may need to petition for guardianship or conservatorship to legally manage their parent’s affairs if the parent becomes incapacitated. This process can be lengthy, complicated, and expensive.

Advantages of a Power of Attorney for Aging Parents

A POA allows seniors to dictate their care and financial management if they become unable to do so. It serves as a safeguard, providing peace of mind that trusted individuals understand and can act on their wishes.

Chad Holmes, founder of Formula Wealth, emphasizes the importance of having someone to make medical and financial decisions when incapacity arises. A POA ensures bills are paid, taxes are filed, medicine is ordered, and doctor’s notes are followed.

POAs also benefit family members by providing clarity on decision-making responsibilities and fostering communication among siblings and other family members as they address their senior loved one’s needs.

Optimal Timing for Establishing a Power of Attorney

Experts and families recommend establishing a POA proactively, before it’s needed. Establishing a POA early can provide seniors with more control over who manages their care and finances.

Common reasons for creating a POA include:

- Alzheimer’s Disease or Other Dementia Diagnosis: It’s vital to set up POA documents before cognitive decline is significant. Executing legal documents can become difficult or impossible once a senior is deemed mentally incapacitated.

- Difficulty with Financial Responsibilities: A POA can allow an adult child to handle finances, even if cognitive decline isn’t an issue.

- Upcoming Surgery: Invasive procedures can lead to complications and require extended recovery times.

- Planned Travel: A POA can authorize someone to handle bills or oversee emergencies in their absence.

- Medical Diagnosis: A senior with a serious diagnosis may want to ensure their wishes are met if they become incapacitated.

- Unstable Family Relationships: A POA legally designates who is responsible for making decisions on their behalf.

Steps to Obtain a Power of Attorney

Creating a POA generally involves the following steps:

- Choose an Agent: Select someone trustworthy, capable, and reliable, and discuss expectations and responsibilities with them.

- Draft the POA: While families may use online forms or templates, consulting an attorney is highly recommended to ensure the document accurately reflects the principal’s wishes.

- Sign and Execute the Document: States have different rules around signing, with some requiring multiple witnesses and notarized signatures.

- Maintain the Document: The principal should meet frequently with their agent and attorney to review the document and ensure it still meets their needs.

Remember, your loved one must voluntarily initiate the process to create a POA.

Selecting the Right Agent

Choosing an agent is a crucial decision. The agent should be someone with whom the principal has a good relationship. Important characteristics to consider include trustworthiness, clear communication skills, assertiveness, proximity to the senior, specialized medical or financial knowledge, and the ability to manage and execute POA responsibilities. Seniors can choose multiple agents, but it typically should not be more than two.

Naming a successor agent provides additional protection if the original agent is unable or unwilling to serve.

When Does Power of Attorney Expire?

A POA always expires upon the death of the principal. It can also expire if:

- The principal revokes the POA while mentally competent.

- An expiration date is written into the document.

- The conditions or time limit outlined in a limited POA have been met.

- The principal becomes incapacitated and has a non-durable POA.

Easing Family Tensions

Tense sibling relationships or strained parent-child dynamics can complicate POA decisions. An elder care planning meeting can facilitate discussions about expectations, determining how each family member can contribute to the senior’s care.

Tips for a more peaceful planning process include:

- Actively Listen: Take time to understand questions and concerns.

- Address Concerns Directly: Clear communication prevents future conflicts.

- Be Respectful: Maintain positive relationships, even if opinions differ.

Conclusion

Establishing a Power of Attorney is a proactive step towards securing the future care and well-being of loved ones. By understanding the different types of POAs, their benefits, and the process of creating one, families can navigate this important legal arrangement with confidence and clarity. Remember to consult with legal professionals to ensure compliance with state-specific regulations and to tailor the POA to individual needs and circumstances. Planning ahead empowers seniors to maintain control over their lives and ensures their wishes are honored, even when they are unable to express them directly.