Divorce is undoubtedly a stressful experience, especially for stay-at-home parents who have dedicated their time to raising children and may have put their careers on hold. This guide, focusing on “A California Christmas City Lights Parents Guide”, aims to provide essential information and resources to help navigate the complexities of divorce in California.

Understanding Your Divorce Options

Choosing the right divorce process can significantly impact the emotional and financial outcome. Here are several options available in California:

Mediation: A neutral third-party mediator assists both spouses in reaching a mutually agreeable divorce settlement outside of court. Mediation is often a cost-effective and less adversarial approach.

Collaborative Divorce: Each spouse hires a specially trained collaborative divorce attorney to negotiate the terms of the divorce. This process often involves other experts like forensic accountants and child custody specialists. If an agreement cannot be reached, the parties must start the divorce process over with new attorneys.

Uncontested Divorce: When both spouses agree on most aspects of the divorce, they can pursue an uncontested divorce. One spouse may hire an attorney to draft the agreement and handle the paperwork. While DIY divorces are possible, consulting with a family law attorney is crucial to protect your financial rights.

Litigation: Going to court should be a last resort due to its expense, public nature, and potential for loss of control over the outcome. In some cases, litigation may be necessary.

A skilled divorce lawyer can help you evaluate your situation and determine the most appropriate divorce method.

Child Support in California

California law emphasizes that both parents share equal responsibility for their children’s upbringing.

When calculating child support, California courts primarily consider these factors:

1. Income (Net Disposable & Passive): The court considers both net disposable income (after taxes and deductions) and passive income (from sources like stocks and rental properties).

2. Deductions: Allowable deductions include childcare costs, health insurance premiums, mortgage payments, and required retirement contributions.

3. Child Custody Percentage: The amount of time each parent spends with the children significantly influences child support calculations. However, more time with the children doesn’t automatically guarantee child support, as it depends on income and deductions.

4. Child’s Standard of Living: California aims to ensure that children maintain a consistent standard of living between both households.

A complex child support formula is used to determine the exact amount of child support.

Parents can create child support and child custody agreements outside of court, but a judge must approve them to be legally binding.

Spousal Support: Temporary and Long-Term

California offers two types of spousal support:

Temporary Spousal Support: Paid during the divorce proceedings to provide monthly income to the lower-earning spouse.

Long-Term Spousal Support: A monthly payment that can last for an extended period. The duration depends on various factors, including:

- Length of the marriage

- Earning capacity of both spouses

- Age and health of both spouses

- Time needed for the non-working spouse to become self-supporting

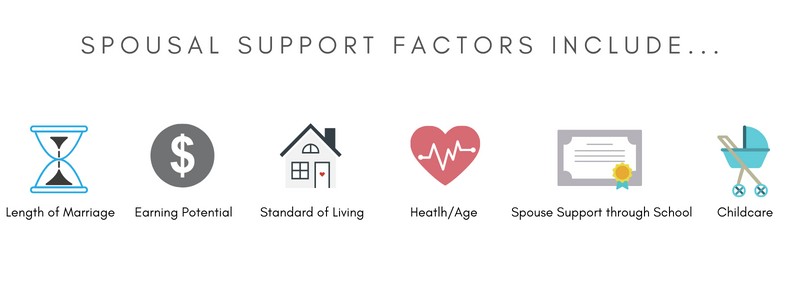

The court considers numerous factors when determining the amount of long-term spousal support, including:

- Length of the marriage

- Earning capacity of each spouse

- Standard of living during the marriage

- Age and health of each spouse

- Contributions to the other spouse’s education or career

- Whether one spouse stayed home to raise children

- Income of the working spouse

- Property and debts of the couple

- Impact of returning to work on the children

- Impact of current tax laws on spousal support

- History of domestic abuse

- Any other relevant factor

Spouses can reach a written agreement on spousal support, or a judge can order support after a trial.

Creating a Career Plan

Even with spousal and/or child support, it is essential to develop a plan for self-sufficiency. Consider options such as:

- Returning to school

- Seeking employment to gain experience

- Pursuing certifications

- Taking career exploration classes

Exploring readily available work-from-home opportunities can provide income and valuable experience:

- Online teacher/tutor

- Travel consultant

- Bookkeeping

- Proofreading

- Customer service representative

- Data entry specialist

- Freelance work (graphic design, marketing, copywriting, virtual assistant, etc.)

Financial Planning for the Future

Taking control of your finances is crucial:

Create a Budget: Track your monthly expenses and differentiate between needs and wants. Utilize free budgeting tools like EveryDollar.

Open Your Own Bank Account: Establish financial independence by opening a personal bank account. Remember to disclose this account during divorce proceedings.

Open Your Own Credit Line: Build your personal credit score by opening a credit card.

Start Saving for Retirement: Contribute to a 401k or consider a Roth IRA to begin investing for retirement.

Meet with a Financial Planner: A financial planner can help you develop a long-term financial strategy and optimize your investments.

Funding Your Divorce

Divorce can be expensive. Here are ways stay-at-home parents can fund their divorce:

Use Savings: Set aside money in a separate account for legal fees, but be prepared to declare it during the divorce.

Spouse Funded Litigation: California courts can order the working spouse to pay for the stay-at-home parent’s legal fees.

Borrow from Retirement: While not ideal, some borrow from their retirement accounts to fund their divorce, aiming to reimburse the account quickly.

Borrow From Family: Borrowing from friends or family can be a viable option, with repayment from the divorce settlement.

Minimizing Divorce Costs

Strategic choices can help keep divorce costs down:

Mediation: Compromise and willingness to agree can significantly reduce legal fees through mediation.

Create a Divorce Binder: Organize relevant paperwork and information to save your attorney time and money. The binder should include:

- List of assets and debts

- Recent account statements

- Escrow paperwork for the house

- Retirement account balances

- Year-end pay stubs

- Tax returns

- Video walkthrough of the house

Obtain a Written Fee Agreement: Understand the billing rates for all legal professionals and ensure costs are not marked up.

Let Some Things Go: Be strategic about what you fight for. Dividing assets should be a cost-benefit analysis.

Go to Therapy: Seek emotional support from a therapist to avoid unnecessary hourly billing with your divorce lawyer.

Navigating divorce as a stay-at-home parent can be challenging. Understanding your options, seeking professional guidance, and focusing on your future will help you emerge stronger on the other side.