Building an effective deal team is crucial for success in any business environment. This how-to build your deal team guide from CONDUCT.EDU.VN explores the essential elements of creating a high-performing team, from defining roles and responsibilities to fostering collaboration and ensuring ethical conduct. Equip yourself with the knowledge to assemble a team that drives growth and achieves your strategic objectives, while ensuring compliance and ethical practices.

1. Understanding the Importance of a Deal Team

A deal team is a specialized group of individuals assembled to manage and execute specific transactions, such as mergers, acquisitions, investments, or strategic partnerships. These teams are vital for several reasons:

- Expertise and Specialization: Deal teams bring together individuals with diverse skill sets, including financial analysis, legal expertise, negotiation skills, and industry-specific knowledge. This specialization ensures that every aspect of the transaction is handled with precision and care.

- Risk Management: By carefully assessing potential risks and opportunities, deal teams can help mitigate financial, legal, and operational risks associated with the transaction. Their thorough due diligence processes help uncover potential pitfalls before they become costly problems.

- Strategic Alignment: A well-structured deal team ensures that the transaction aligns with the organization’s overall strategic goals. They work to maximize the value of the deal and ensure it contributes to long-term success.

- Efficiency and Coordination: Deal teams streamline the transaction process by coordinating activities across different departments and external advisors. This coordination improves efficiency and helps keep the deal on track.

- Negotiation Power: With a strong team of negotiators, companies can secure favorable terms and conditions. Skilled negotiators can identify key leverage points and navigate complex discussions to achieve the best possible outcome.

2. Key Roles and Responsibilities in a Deal Team

Identifying the right roles and responsibilities is critical to building a successful deal team. The specific roles may vary depending on the nature and complexity of the transaction, but the following are common positions:

2.1. Deal Team Leader

The Deal Team Leader is responsible for overseeing the entire transaction process, from initial planning to final execution. Their responsibilities include:

- Strategic Direction: Setting the strategic direction for the deal and ensuring that all team members are aligned with the overall objectives.

- Team Coordination: Coordinating the activities of all team members and ensuring that tasks are completed on time and within budget.

- Decision Making: Making critical decisions throughout the transaction process, often in consultation with other team members and senior management.

- Stakeholder Management: Managing relationships with key stakeholders, including internal executives, external advisors, and counterparties.

- Communication: Ensuring clear and effective communication among team members and with external parties.

2.2. Financial Analyst

The Financial Analyst plays a crucial role in evaluating the financial aspects of the transaction. Their responsibilities include:

- Financial Modeling: Developing financial models to assess the potential value and risks of the transaction.

- Due Diligence: Conducting thorough financial due diligence to verify the accuracy of financial information and identify potential issues.

- Valuation Analysis: Performing valuation analysis to determine the fair market value of the target company or assets.

- Financial Reporting: Preparing financial reports and presentations for internal stakeholders and external advisors.

- Transaction Structuring: Assisting with the structuring of the transaction to optimize financial outcomes.

2.3. Legal Counsel

Legal Counsel provides essential legal guidance and support throughout the transaction process. Their responsibilities include:

- Legal Due Diligence: Conducting legal due diligence to identify potential legal risks and liabilities.

- Contract Negotiation: Negotiating and drafting legal documents, such as purchase agreements, merger agreements, and financing agreements.

- Regulatory Compliance: Ensuring compliance with all applicable laws and regulations.

- Risk Assessment: Assessing and mitigating legal risks associated with the transaction.

- Dispute Resolution: Handling any legal disputes that may arise during the transaction process.

2.4. Technical Expert

The Technical Expert provides specialized knowledge and expertise related to the technical aspects of the transaction. Their responsibilities include:

- Technical Due Diligence: Conducting technical due diligence to assess the target company’s technology, infrastructure, and intellectual property.

- Risk Assessment: Identifying and evaluating technical risks associated with the transaction.

- Integration Planning: Developing plans for integrating the target company’s technology and systems.

- Technical Support: Providing technical support and guidance to other team members.

- Innovation Assessment: Evaluating the potential for innovation and technological advancements.

2.5. Operations Specialist

The Operations Specialist focuses on the operational aspects of the transaction, ensuring a smooth transition and integration. Their responsibilities include:

- Operational Due Diligence: Conducting operational due diligence to assess the target company’s processes, systems, and infrastructure.

- Integration Planning: Developing and implementing plans for integrating the target company’s operations.

- Process Improvement: Identifying opportunities to improve operational efficiency and effectiveness.

- Change Management: Managing the changes associated with the transaction to minimize disruption and maximize employee engagement.

- Supply Chain Analysis: Analyzing and optimizing supply chain operations.

2.6. Human Resources (HR) Specialist

The HR Specialist is responsible for managing the human capital aspects of the transaction, ensuring a fair and equitable process for all employees. Their responsibilities include:

- HR Due Diligence: Conducting HR due diligence to assess the target company’s employee base, compensation, and benefits.

- Integration Planning: Developing and implementing plans for integrating the target company’s workforce.

- Employee Communication: Communicating with employees about the transaction and addressing their concerns.

- Talent Management: Identifying and retaining key talent within the target company.

- Compliance: Ensuring compliance with all applicable labor laws and regulations.

3. Building the Ideal Deal Team

Building an ideal deal team involves careful planning and consideration of various factors. Here are some key steps to follow:

3.1. Define the Objectives of the Deal

Before assembling the team, clearly define the objectives of the transaction. What are you hoping to achieve? What are the key success factors? This clarity will help you identify the skills and expertise needed on the team.

3.2. Identify Required Skills and Expertise

Based on the deal objectives, identify the specific skills and expertise required. This may include financial analysis, legal knowledge, technical expertise, operational experience, and industry-specific knowledge.

3.3. Select Team Members

Choose team members who possess the required skills and expertise. Consider both internal employees and external advisors, such as lawyers, accountants, and consultants.

3.4. Assign Roles and Responsibilities

Clearly define the roles and responsibilities of each team member. Ensure that everyone understands their tasks and how they contribute to the overall success of the transaction.

3.5. Establish Communication Protocols

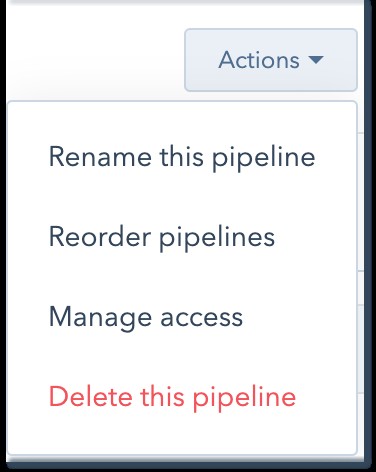

Establish clear communication protocols to ensure that team members can effectively share information and coordinate activities. This may include regular meetings, email updates, and project management software.

3.6. Foster Collaboration

Encourage collaboration among team members by creating a supportive and inclusive environment. This will help foster innovation and improve decision-making.

3.7. Provide Training and Resources

Provide team members with the training and resources they need to succeed. This may include training on financial modeling, legal concepts, technical skills, and project management.

3.8. Monitor Progress and Performance

Regularly monitor the progress of the transaction and the performance of team members. Provide feedback and make adjustments as needed to ensure that the deal stays on track.

4. Essential Skills for Deal Team Members

Beyond specific expertise, certain essential skills are crucial for all deal team members. These include:

- Communication: Effective communication is essential for sharing information, coordinating activities, and managing relationships with stakeholders.

- Problem-Solving: Deal team members must be able to identify and solve complex problems quickly and effectively.

- Negotiation: Strong negotiation skills are essential for securing favorable terms and conditions.

- Analytical Thinking: Deal team members must be able to analyze complex data and make informed decisions.

- Project Management: Effective project management skills are essential for keeping the deal on track and within budget.

- Teamwork: Deal team members must be able to work effectively in a team environment, collaborating with others to achieve common goals.

- Ethical Conduct: Maintaining the highest standards of ethical conduct is essential for building trust and maintaining a positive reputation.

5. Common Challenges in Building a Deal Team

Building a successful deal team is not without its challenges. Some common issues include:

5.1. Lack of Expertise

Finding individuals with the specific skills and expertise required for the transaction can be challenging. Companies may need to rely on external advisors to fill these gaps.

5.2. Communication Barriers

Communication barriers can hinder collaboration and lead to misunderstandings. Establishing clear communication protocols and fostering a culture of open communication can help overcome these challenges.

5.3. Conflicting Priorities

Team members may have conflicting priorities, especially if they are also working on other projects. Clearly defining roles and responsibilities and aligning incentives can help mitigate this issue.

5.4. Time Constraints

Deal teams often face tight deadlines, which can put pressure on team members and lead to errors. Effective project management and resource allocation can help manage time constraints.

5.5. Resistance to Change

Resistance to change can hinder the integration of the target company and prevent the deal from achieving its full potential. Effective change management and communication can help overcome resistance.

6. Best Practices for Deal Team Management

Effective deal team management is essential for ensuring the success of the transaction. Here are some best practices to follow:

- Start Early: Begin assembling the deal team as early as possible in the transaction process. This will give team members time to prepare and develop a comprehensive plan.

- Set Clear Goals: Clearly define the goals of the transaction and communicate them to all team members. This will help ensure that everyone is aligned and working towards the same objectives.

- Empower Team Members: Empower team members to make decisions and take ownership of their tasks. This will help foster a sense of responsibility and improve performance.

- Provide Regular Feedback: Provide team members with regular feedback on their performance. This will help them improve their skills and contribute more effectively to the transaction.

- Celebrate Successes: Celebrate the successes of the deal team. This will help boost morale and encourage continued high performance.

- Learn from Failures: Analyze failures to identify lessons learned and improve future performance. This will help the deal team become more effective over time.

- Ensure Ethical Conduct: Maintain the highest standards of ethical conduct throughout the transaction process. This will help build trust and maintain a positive reputation.

7. Leveraging Technology in Deal Team Management

Technology plays an increasingly important role in deal team management. Various tools and platforms can help streamline the transaction process and improve communication and collaboration. Some useful technologies include:

- Project Management Software: Tools like Asana, Trello, and Microsoft Project can help manage tasks, track progress, and coordinate activities.

- Collaboration Platforms: Platforms like Slack, Microsoft Teams, and Google Workspace can facilitate communication and collaboration among team members.

- Data Analysis Tools: Tools like Excel, Tableau, and Power BI can help analyze financial data and identify trends.

- Due Diligence Software: Specialized software can help streamline the due diligence process by organizing documents, tracking requests, and identifying potential issues.

- Contract Management Systems: These systems help manage contracts, track deadlines, and ensure compliance with legal requirements.

8. Ethical Considerations for Deal Teams

Ethical conduct is paramount in deal-making. Deal teams must adhere to the highest ethical standards to maintain trust and credibility. Key ethical considerations include:

- Confidentiality: Protecting confidential information is essential. Team members should sign non-disclosure agreements and adhere to strict confidentiality policies.

- Integrity: Honesty and transparency are crucial. Deal team members should avoid conflicts of interest and disclose any potential issues.

- Fairness: Treating all parties fairly and equitably is essential. Deal team members should avoid engaging in deceptive or manipulative practices.

- Compliance: Adhering to all applicable laws and regulations is mandatory. Deal team members should be aware of legal requirements and ensure compliance.

- Responsibility: Taking responsibility for one’s actions and decisions is essential. Deal team members should be accountable for their conduct and its impact on the transaction.

Codes of ethics, such as those provided by professional organizations like the CFA Institute, offer guidance on ethical conduct in finance and investment. The CFA Institute’s Code of Ethics and Standards of Professional Conduct emphasizes integrity, competence, diligence, respect, and ethical behavior.

9. Case Studies of Successful Deal Teams

Examining case studies of successful deal teams can provide valuable insights and lessons learned. Here are a few examples:

9.1. The Acquisition of Whole Foods Market by Amazon

Amazon’s acquisition of Whole Foods Market in 2017 is a prime example of a successful deal. The deal team included experts in finance, law, technology, and retail. They conducted thorough due diligence, negotiated favorable terms, and successfully integrated Whole Foods into Amazon’s ecosystem.

9.2. The Merger of Dow Chemical and DuPont

The merger of Dow Chemical and DuPont in 2017 created a new chemical giant, DowDuPont. The deal team included experts in finance, law, operations, and human resources. They carefully planned the integration process, addressed regulatory concerns, and achieved significant cost synergies.

9.3. The Acquisition of LinkedIn by Microsoft

Microsoft’s acquisition of LinkedIn in 2016 is another example of a successful deal. The deal team included experts in technology, finance, and human resources. They recognized the strategic value of LinkedIn and successfully integrated it into Microsoft’s portfolio of products and services.

10. Ensuring Compliance and Ethical Practices

Compliance and ethical practices are integral to the success of any deal team. Companies must implement policies and procedures to ensure that all team members adhere to the highest standards of conduct. Key steps include:

- Develop a Code of Conduct: Create a comprehensive code of conduct that outlines ethical expectations and responsibilities.

- Provide Ethics Training: Provide regular ethics training to all deal team members. This training should cover topics such as conflicts of interest, confidentiality, and compliance with laws and regulations.

- Establish a Whistleblower Policy: Create a whistleblower policy that encourages employees to report ethical violations without fear of retaliation.

- Conduct Regular Audits: Conduct regular audits to ensure compliance with policies and procedures.

- Enforce Disciplinary Action: Enforce disciplinary action for ethical violations. This will send a clear message that unethical conduct will not be tolerated.

11. Future Trends in Deal Team Management

The field of deal team management is constantly evolving. Here are some future trends to watch:

- Increased Use of Artificial Intelligence (AI): AI is being used to automate tasks, analyze data, and improve decision-making. Deal teams will increasingly rely on AI to enhance their efficiency and effectiveness.

- Greater Focus on Environmental, Social, and Governance (ESG) Factors: ESG factors are becoming increasingly important in deal-making. Deal teams will need to consider the environmental, social, and governance implications of transactions.

- More Emphasis on Cybersecurity: Cybersecurity is a growing concern for deal teams. They will need to assess the cybersecurity risks associated with transactions and implement measures to protect sensitive data.

- Increased Scrutiny from Regulators: Regulators are increasing their scrutiny of mergers and acquisitions. Deal teams will need to be prepared to address regulatory concerns and demonstrate compliance with antitrust laws.

- Greater Use of Remote Collaboration Tools: Remote collaboration tools are becoming more sophisticated. Deal teams will increasingly rely on these tools to work together effectively, regardless of location.

12. FAQs About Building Deal Teams

Here are some frequently asked questions about building deal teams:

12.1. What is the ideal size for a deal team?

The ideal size of a deal team depends on the complexity of the transaction. A small, simple deal may only require a few team members, while a large, complex deal may require dozens of team members.

12.2. How do I choose the right team members?

Choose team members who possess the required skills and expertise for the transaction. Consider both internal employees and external advisors.

12.3. How do I ensure effective communication among team members?

Establish clear communication protocols and foster a culture of open communication. Use collaboration platforms and project management software to facilitate communication and coordination.

12.4. How do I manage conflicts of interest?

Require team members to disclose any potential conflicts of interest. Implement policies and procedures to manage conflicts and ensure that decisions are made in the best interests of the company.

12.5. How do I ensure ethical conduct among team members?

Develop a code of conduct, provide ethics training, and establish a whistleblower policy. Enforce disciplinary action for ethical violations.

12.6. What is the role of external advisors in a deal team?

External advisors, such as lawyers, accountants, and consultants, can provide specialized expertise and support. They can assist with due diligence, contract negotiation, and regulatory compliance.

12.7. How do I measure the success of a deal team?

Measure the success of a deal team based on the achievement of the transaction objectives. Consider factors such as financial performance, strategic alignment, and risk management.

12.8. What are the key performance indicators (KPIs) for a deal team?

Key performance indicators (KPIs) for a deal team may include:

- Time to close the deal

- Deal value

- Cost savings

- Revenue growth

- Return on investment (ROI)

- Customer satisfaction

- Employee retention

12.9. How do I motivate and incentivize deal team members?

Motivate and incentivize deal team members through a combination of financial rewards, recognition, and opportunities for professional development.

12.10. What are the common mistakes to avoid when building a deal team?

Common mistakes to avoid when building a deal team include:

- Failing to define the objectives of the deal

- Selecting team members without the required skills and expertise

- Failing to establish clear communication protocols

- Failing to manage conflicts of interest

- Failing to ensure ethical conduct

Conclusion

Building a successful deal team requires careful planning, selection, and management. By following the guidelines outlined in this how-to build your deal team guide, you can assemble a team that drives growth, manages risk, and achieves your strategic objectives. Remember, ethical conduct and compliance are paramount. For more detailed guidance and resources, visit CONDUCT.EDU.VN.

Need help navigating the complexities of ethical standards and compliance? Contact us today:

Address: 100 Ethics Plaza, Guideline City, CA 90210, United States

WhatsApp: +1 (707) 555-1234

Website: CONDUCT.EDU.VN

Let conduct.edu.vn be your partner in building a deal team that not only achieves success but also upholds the highest ethical standards.