This guide offers a concise overview of responsible investment, explaining its principles and practical applications. It sheds light on how environmental, social, and governance (ESG) factors play a crucial role in informed investment decisions. We’ll explore the meaning of guides in this context, how to invest responsibly, address common misconceptions, and understand the role of the Principles for Responsible Investment (PRI).

Understanding Responsible Investment

Responsible investment involves integrating environmental, social, and governance (ESG) considerations into investment decisions and actively influencing companies or assets through active ownership or stewardship. This approach complements traditional financial analysis and portfolio construction.

Responsible investors pursue various objectives. Some prioritize financial returns, using ESG factors to mitigate risks and enhance performance. Others aim to generate both financial returns and positive social and environmental impact, avoiding negative consequences.

ESG issues include:

| ENVIRONMENTAL | SOCIAL | GOVERNANCE |

| Climate change | Human rights | Board structure |

| Circular economy | Decent work | Executive remuneration |

| Biodiversity | Diversity, equity, and inclusion | Tax fairness |

| Deforestation | Responsible political engagement |

What does “guides” mean in responsible investing? Guides, in this context, refer to resources, frameworks, and methodologies that provide direction and support to investors in navigating the complexities of responsible investment. These guides offer practical advice, best practices, and tools for integrating ESG factors into investment processes, engaging with companies on sustainability issues, and measuring the impact of responsible investment strategies.

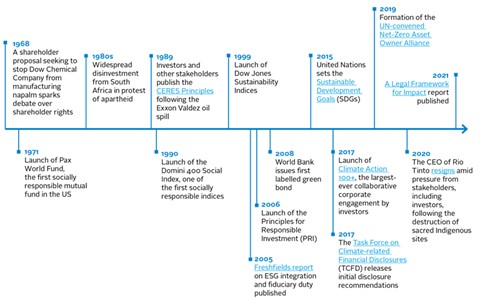

The Evolution of Responsible Investment: A Timeline

The Compelling Reasons to Embrace Responsible Investment

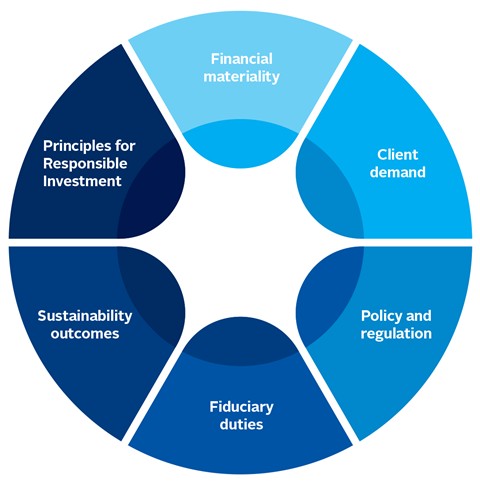

Several interconnected factors are fueling the growth of responsible investment:

Financial Materiality

Growing evidence demonstrates a link between ESG issues and financial performance. Engaging with companies on ESG matters can enhance risk management and promote sustainable practices, creating value for businesses and investors.

Sustainability issues can significantly impact market and portfolio returns, posing risks that extend beyond individual companies or sectors.

Examples of financially material ESG incidents and sustainability issues:

- 2019: Vale’s dam collapse resulted in significant loss of life and environmental damage, leading to substantial financial settlements.

- 2020: Wirecard’s insolvency, linked to accounting fraud, highlighted the importance of corporate governance.

- 2020: The COVID-19 pandemic underscored the economic consequences of inadequate investment in pandemic preparedness.

- 2022: Lafarge faced charges of complicity in crimes against humanity, demonstrating the legal and reputational risks associated with human rights violations.

Client Demand

Asset owners and beneficiaries increasingly recognize the financial materiality of ESG factors and seek investments aligned with their values and broader sustainability objectives. They expect investment managers to prioritize responsible investment.

Policy and Regulation

Regulations related to ESG issues and disclosures are on the rise, reflecting the financial sector’s role in addressing global challenges. Governments and regulators are implementing policies to promote sustainable finance and responsible investment.

Fiduciary Duties

Fiduciary duties require investors to consider all factors relevant to investment returns, including ESG issues. In some jurisdictions, investors are legally obligated to pursue sustainability outcomes that align with their financial objectives.

Sustainability Outcomes

Investment activities can generate positive and negative sustainability outcomes. Stakeholders increasingly expect investors to manage these outcomes and align their activities with global frameworks like the Sustainable Development Goals (SDGs) and the Paris Agreement.

Principles for Responsible Investment (PRI)

Many investors have committed to the Principles for Responsible Investment, pledging to:

- Incorporate ESG issues into investment analysis and decision-making.

- Be active owners and incorporate ESG issues into ownership policies and practices.

- Seek appropriate disclosure on ESG issues by investees.

- Promote acceptance and implementation of the Principles within the investment industry.

- Work together to enhance effectiveness in implementing the Principles.

- Report on activities and progress towards implementing the Principles.

Navigating the Landscape: How to Invest Responsibly

Responsible investment encompasses various strategies, including:

| ESG Incorporation | Stewardship |

|---|---|

| Screening | ESG integration |

| Taking action on sustainability outcomes |

ESG Incorporation

ESG incorporation involves integrating ESG considerations into existing investment practices through screening, ESG integration, and thematic investing.

| Screening: Applying filters based on ESG criteria. | ESG Integration: Considering ESG issues in investment analysis. | Thematic Investing: Focusing on opportunities created by long-term ESG trends. |

Stewardship

Stewardship involves using influence to maximize long-term value, considering economic, social, and environmental assets. Engagement with investees and other stakeholders is a key component of stewardship.

Taking Action on Sustainability Outcomes

Investors can improve sustainability outcomes by aligning their investments with global sustainability goals and thresholds, such as the UN Sustainable Development Goals and the Paris Agreement.

Responsible Investment Across Asset Classes

Responsible investment is possible across all asset classes, with varying tools for achieving objectives.

- Fixed Income: Incorporating ESG provisions into bond covenants.

- Listed Equity: Exercising voting rights to influence company behavior.

- Private Equity: Utilizing board seats to shape ESG strategy.

The Role of Asset Owners and Reporting

Asset owners set the direction for sustainable investing. They can integrate responsible investment principles into their selection and monitoring of external investment managers. Reporting on ESG incorporation and stewardship practices is crucial for transparency and accountability.

Key ESG Issues: Climate Change and Human Rights

Climate change and human rights are high-priority ESG issues for investors. Addressing climate change requires reducing greenhouse gas emissions. Respecting human rights is a fundamental responsibility for institutional investors.

Debunking Myths: Addressing Misconceptions About Responsible Investment

Common misconceptions about responsible investment include:

- “It involves investing in a specific strategy or product.” – Responsible investment encompasses various approaches, depending on investor objectives.

- “It leads to lower investment returns.” – Responsible investment can enhance risk and return characteristics.

- “It involves limiting the investible universe.” – Screening is not a mandatory element of responsible investment.

- “It is not possible to invest responsibly as an index investor.” – ESG factors can be integrated into index-investment strategies.

- “It is politically motivated.” – Responsible investment focuses on informed decision-making and aligning investments with beneficiaries’ objectives.

- “It is not possible to substantiate responsible investment claims.” – Regulations and taxonomies are being developed to counter greenwashing.

The PRI’s Vital Role in Promoting Responsible Investment

The PRI is a global organization that supports the investment industry in investing responsibly. It provides resources and guidance to signatories committed to implementing the six Principles for Responsible Investment.

In conclusion, guides play a pivotal role in responsible investing, providing investors with the knowledge, tools, and frameworks necessary to integrate ESG factors into their investment decisions and contribute to a more sustainable future. By understanding the principles and practices of responsible investment, investors can generate both financial returns and positive social and environmental impact.